Slight growth in cargo transhipment in North Sea Port

Seaborne transhipment increased by 0.4 million tons of goods compared to the serious dip in 2023. This slight improvement is due to North Sea Port's distinctive profile as a bulk port: dry bulk and break bulk (general cargo) throughput increased significantly. The diversification of activities at our port often provides a counterbalance in uncertain times – on the other side of the scale, liquid bulk transhipment fell. The decline of specific products linked to a (cautious) industrial sector is making its impact felt in our port.

Seaborne transhipment with Great Britain actually increased by more than a quarter, making it our number one trading partner. The impact of Brexit seems to be a thing of the past in terms of tons of goods transhipment, and North Sea Port continues to strengthen its role as a port firmly positioned in the heart of Europe.

Inland waterway transhipment is prospering, posting growth of just under 5%. North Sea Port’s ideal location at the intersection of Western European inland waterways, our excellent port infrastructure and modal shift projects aimed at transporting more goods via inland waterways are boosting this sustainable form of transport. And, not least, the distinctive nature of the products handled in the port – specifically bulk goods – lends itself perfectly to inland navigation.

30 hectares of land set for release

The challenges for the years ahead are many – certainly on the geopolitical front, with the Russia-Ukraine war and ongoing tensions in the Middle East, as well as the United States and possible trade barriers. In addition, there has been a slowdown in the energy transition and there remains an urgent need for a level and competitive playing field within Europe and a European Industrial Deal.

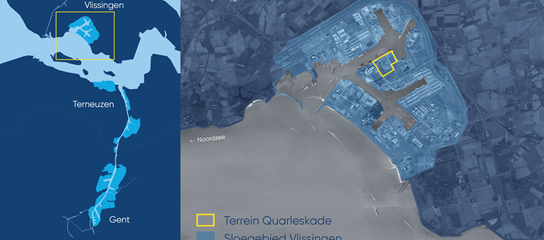

However, North Sea Port looks forward to significant investment in the coming years. The raft of upcoming investments for 2025 in the energy, offshore, logistics and circularity sectors offer the prospect of additional jobs and additional financial security for the port authority. North Sea Port expects to release 30 hectares of land by 2025, the same amount as in 2024.

The challenges of industry are often plainly reflected in the transhipment figures – which is clearly the case with the reduced figures for liquid bulk transhipment. However, once industry regains its momentum – in the context of a European industrial and sustainability policy – the tide may turn, putting us back on course as a leading European port.

Bulk port par excellence

North Sea Port remains, above all, a bulk port. Dry and liquid bulk still make up a full three quarters of transhipment.

Dry bulk increased again (+2.1%) and continues to account for more than half (54%) of all transhipment (35.9 million tons). The rise was the result of increased supplies of iron ore, wood pellets, chemicals and soya beans. The transhipment of construction materials kept pace, while that of rapeseed decreased.

Break bulk also grew (+7%) and continues to represent 15% of throughput (10.2 million tons). Within that figure, cellulose transhipment increased, while sheet steel decreased.

Transhipment of rolling stock, ro/ro, remained at the same level at 3.7 million tons, with the segment also retaining the same share of total transhipment (6%).

Liquid bulk transhipment fell (-3.5%), and now accounts for a little over a fifth of total maritime transhipment (22%, 14.6 million tons). This reflects a decline in petroleum products, biodiesel and basic chemicals – products which are characteristic of industry.

Container transhipment witnessed a loss in tonnage (-18%), posting a total of 1.8 million tons or 175,000 TEU (-50,000 TEUs). The share of containers within total seaborne cargo transhipment did remain the same (3%).

In terms of commodity types, we saw an increase in agricultural products (+4.9%, a partial recovery after losses in 2023), ores and metal residues (+5.8, due to increased volumes of iron ores), fertilisers (+5.7%), chemical products (+7%), vehicles and machinery, and other manufactures (+14.7%, including cellulose). Solid fuels remained static. A decrease was observed in food products (-13%, including less rapeseed), petroleum products (-4%), crude minerals and construction materials (-3%) and metal industry products (-11%, reduced steel transhipment).

The import/export ratio for seaborne transhipment was 70%-30%, which represents a slight rise in export share over the years.

Great Britain pushes United States out of first place

With 6.0 million tons of cargo throughput and solid growth (+26%, +1.2 million tons), Great Britain is firmly in first place among North Sea Port's main trading partners – as such, the impact of Brexit is (hopefully) a thing of the past. The United States experienced its second consecutive year of decline (-6% = -300,000 tons), moving from first to second place, with a total of 5.1 million tons. Trade with Sweden increased (+8%, +300,000 tons), pushing the country up to third place with a transhipment volume of 4.3 million tons.

Canada again took fourth place, followed by Brazil, Norway, Spain, France, Russia and Turkey in tenth place.

Of total seaborne cargo traffic, Europe accounted for 58% (+2%), North America 14% (no change), South America 14% (-1%), Africa 7% (no change) and Asia 3% (-1%). Finally, Oceania’s share (4%) remained stable.

Growth also seen in inland navigation

Cargo transhipment via inland navigation totalled 64.2 million tons in 2024. This increase of 4.4% almost made up for the losses in 2023 compared to 2022 (which was the second record year in a row).

Liquid bulk handling rose by 7% to 34.5 million tons, partly thanks to increases in liquid petroleum fuels and basic chemicals. Dry bulk grew by 5% to 23.3 million tons due to additional transhipment of animal feeds, sand and gravel and crude minerals.

Containers declined by 15% to 2.2 million tons. In terms of TEUs, there was a 17% drop to 240,000 TEUs.

Ro/ro barges accounted for 0.1 million tons (no change). Breakbulk decreased slightly by 3% to 4.0 million tons.

The import-export ratio remained unchanged at 41%-59%.